There have been mixed messages this year as to how consumers will be spending this Christmas period – whilst the numbers seem to be rising slightly with PatelMiller quoting a 3.5% increase in spending compared to December 2012, some are also warning against a Christmas spending slump. Marketers need to prepare for cautious spenders this Christmas and look at how best to tackle any projected spending slump through intelligently targeted campaigns.

Over the last decade, the advent of social media, the proliferation of smartphones, tablets and new devices, and access to limitless data regardless of location have led to the always-on, connected consumer. Whereas retailers used to lead from the front in terms of marketing and brand reputation, connected consumers now have the channels to dictate to these brands when and where they receive their communications – without this engagement, retailers run the risk of losing customers.

It now goes without saying that any multi-channel marketing campaign must ensure that it is reaching the right customers on the appropriate channel, at the appropriate time and at the appropriate price point. Customers demand a seamless experience regardless of the channel or device they use to interact with the brand.

Changing habits

Alongside the ever evolving consumer relationship with the multitude of devices in their lives, emerging spending trends can also affect all of the above, and insight from Experian shows that this year, festive spending habits are changing, and these changes are happening in specific regions of the UK.

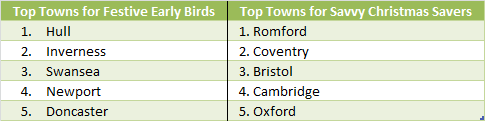

In 2012, for the first time, UK retailers began their Boxing Day Sales weeks in advance of Christmas with the result that many consumers across the UK will be holding out for the same savings this year. This is creating two types of festive shoppers – the “Festive Early Birds” who get their Christmas shopping wrapped up at the beginning of the month, and the “Savvy Christmas Savers” who hold out for the sales and make their money go further.

Based on last Christmas’s shopping trends, we can see the top towns in the UK that are either Festive Early Birds, or Savvy Christmas Savers.

Not only are certain regions changing their shopping habits in line with this Christmas sales creep but certain mosaic groups are more likely to do this too.

We know for example that Festive Early Birds are mid 40s to mid 60’s, married, parents and have families with children under 15. They are twice as likely as the general population to have a household income over £100,000 and they focus on quality when shopping.

- Early shoppers are most likely to be in the following Mosaic groups:

- Rural Solitude (residents of small villages)

- Careers and Kids (suburban families with young children and two good salaries)

- Professional Rewards (wealthy and experienced professionals living in suburban or semi-rural homes)

Savvy Christmas Savers on the other hand are aged 18-25, students and young professionals, living in student houses or home sharing with low incomes earning less than £10,000 per year. These are the bargain hunters who look for the cheapest products.

- Top Mosaic groups for savvy shoppers are:

- Upper Floor Living (young people on limited incomes living in cities)

- Terraced Living (lower income families and workers living in inner urban areas)

Knowing the shopping habits of those that you are targeting enriches any marketing campaign, for example, in December 2012, “liberal opinions” were 51% more likely to use their smartphones for shopping than the rest of the UK in December 2012.

Mobile Mindset

Mobile phones played a key role in last year’s Christmas shopping and data gathered from Experian Hitwise showed that last year visits to mobile retail websites at Christmas grew by 135% compared to 2011. It’s clear that any Christmas marketing campaign needs to have mobile top of mind. And it’s not just shopping on a mobile that’s making an impact.

Smartphones are also expected to influence some £18 billion of in store sales this year according to Deloitte, as consumers increasingly use their devices as a “shop window”. Although only £5bn of sales are likely to be made directly on mobile devices, shoppers who use their phones to look up items before or during their shopping trip are more likely to make a purchase, Deloitte claims.

Most brands understand the need to have a presence across new and innovative channels such as mobile, but those that are successful are the ones that understand how these singular channels fit into the overall marketing mix. Mobile is important, but if your communications and messaging are not consistent across all channels consumers are likely to walk away.

An Experian Marketing Services survey conducted in April 2012 found that 84% of consumers would walk away from a company that doesn’t link up, understand and respond to their engagements across channels. It’s imperative for marketers to catch up with today’s consumer – customers don’t see in channels and neither should brands.

Whilst the success of this Christmas retail period is still an unknown, looking at the data and insights about customers and how they behaved last year is the smartest way to prepare. Knowing who and where the Festive Early Birds are, and how Savvy Christmas Saver’s behave and ensuring your messaging is consistent and tailored across the right channel will ensure that any campaign is intelligent and engages the right people at the right time, on the right platform.