At the end of each quarter, Kenshoo analyses the performance of search and social advertising based on over 6,000 advertisers and agencies who use our platform. This allows us to pick out the key trends, metrics and benchmarks over the period both globally and in key regions.

Below are three key trends we’ve seen in Q2 2015. As if you needed it, they serve as a further reminder about the ever increasing importance of mobile in digital marketing.

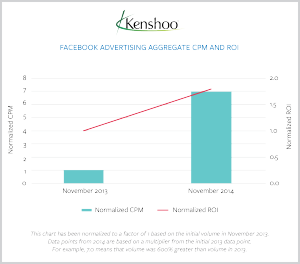

1) Marketers spend 114% more on Facebook advertising with Mobile a key driver

Quarterly global spend on Facebook advertising grew by 114% year-on-year (YoY) in Q2 2015, twice as fast as a year ago. Mobile phone and tablet ad spend is up 167% YoY and together they now account for 63% of total paid social budgets (up from 51% last year).

2) Mobile devices account for over one third of ad revenue from search

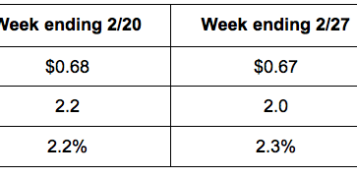

In paid search the research reveals that quarterly spend increased by 10% YoY, fuelled entirely by growth in mobile ads (71%) and tablet ads (4%), while desktop search spend decreased slightly (-2%). Mobile devices are playing an increasingly bigger role in search advertising, accounting for 38% of spend (a 37% YoY rise), 44% of clicks, and 34% of advertiser revenue.

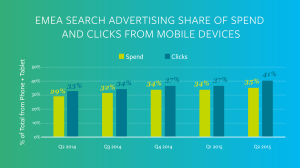

3) Share of mobile clicks and spend reaches all-time high in EMEA

In Europe, Middle East & Africa (EMEA) the share of search advertising spend and clicks taken by mobile devices in reached an all-time high. Mobile devices accounted for 41% of all clicks on search ads in the region and 35% of all spend, with growth in smartphone spend driving the overall spending rise when adjusted for currency fluctuations.

Our analysis reiterates that mobile is now a key driver of ad clicks in both search and social. And with the likes of Instagram now becoming more open to advertisers, we’re likely to see mobile’s role in digital marketing increase even further.

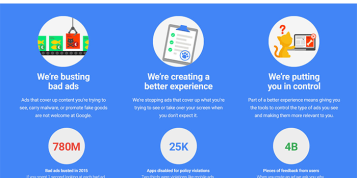

And with consumers now clicking on more mobile ads, it becomes more important than ever that marketers can accurately measure the true impact of ads clicked on different devices ahead of the final sale. For example, if a consumer clicked on a mobile search ad two times before making a purchase on the advertiser’s site via their desktop, how important were the mobile clicks? Google, Facebook and a variety of other companies are using different models and approaches to solve this cross-device attribution puzzle.

You can view infographics highlighting Kenshoo Q2 2015 data here and here.